How does a profits expense ended up being regulation? – Ever asked yourself just how those tax obligation regulations obtain made? It’s a little bit like a legal rollercoaster, with spins, transforms, and a great deal of dispute. Allow’s damage down the trip of a profits expense from preliminary concept to last regulation.

The First Step: The Spark

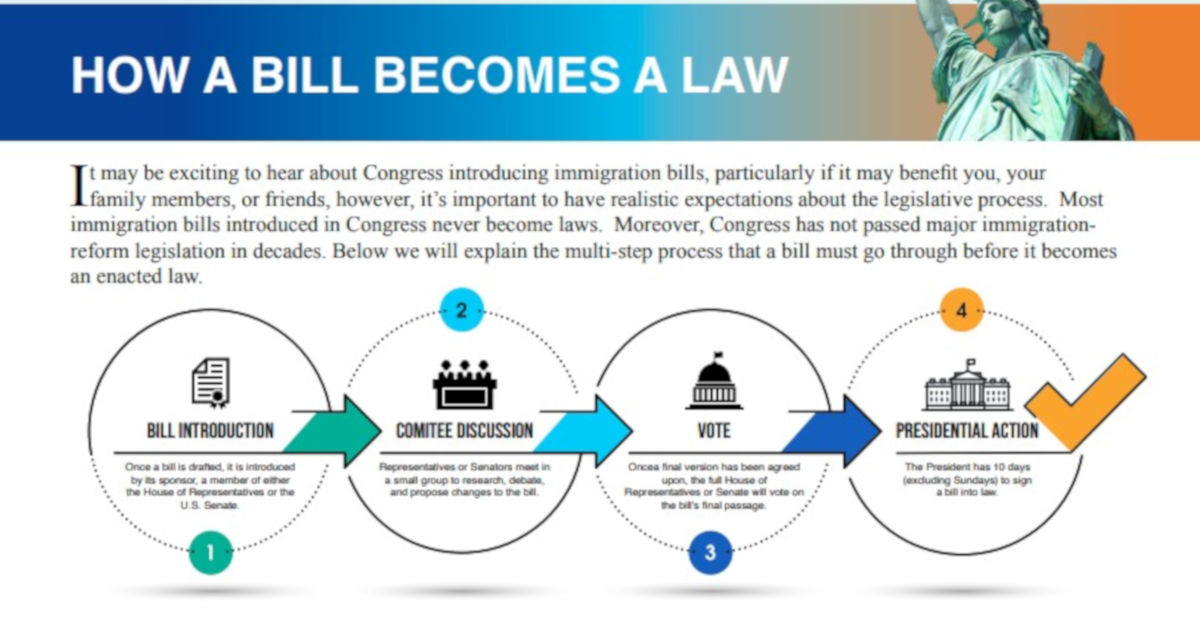

It all begins with a concept. A person, whether it’s a participant of Congress, a powerbroker, or perhaps a worried person, recommends a modification to the tax obligation code. This might be anything from a tiny modification to a significant overhaul. This proposition, a draft of the earnings expense, is after that presented to your house of Representatives or the Senate. Think about it as the initial draft of a paper– it’s subject to a great deal of responses and alteration.

- Idea Generation: Ideas for earnings expenses originated from numerous resources, consisting of federal government companies, single-interest group, and private residents.

- Introduction: The expense is officially presented in among your houses of Congress.

- Committee Review: The expense is described a board for thorough factor to consider and possible alterations.

The Legislative Labyrinth: Committee Work and Floor Debate

Once presented, the expense mosts likely to boards focusing on tax obligation issues. These boards extensively analyze the expense, holding hearings, accumulating proof, and making modifications. Think about it as a strenuous fact-checking procedure. After the board job, the expense mosts likely to the capacity or Senate for dispute. This is where the actual political movie theater occurs, with disagreements, counterarguments, and occasionally enthusiastic speeches. Modifications are commonly recommended and elected on, forming the last kind of the expense.

- Committee Hearings: Stakeholders and professionals give statement on the expense’s influence.

- Markup Sessions: Committees dispute and change the expense.

- Floor Debate: The capacity or Senate elects and talks about on the expense.

The Crossroads: Reconciliation and the President’s Role

If the expense passes both your house and the Senate, it relocates to an essential action. Occasionally, the variations gone by both homes vary. This distinction should be resolved. A meeting board, with participants from both homes, exercises the distinctions and creates a concession expense. The expense goes to the President. The President can either authorize the expense right into regulation or veto it. Congress can try to bypass the veto with a two-thirds ballot in both homes if the President vetoes it. This is a considerable however uncommon occasion, highlighting the equilibriums and checks intrinsic in our system of federal government.

- Conference Committee: Reconciles distinctions in between your house and Senate variations.

- Presidential Action: The President can authorize the expense, veto it, or pick to take no activity (sometimes, this causes automated flow).

- Possible Override: Congress can bypass a governmental veto.

The Final Chapter: The Law of the Land

Once authorized right into regulation, the earnings expense enters into the U.S. tax obligation code. This affects every person, from local business to big firms, and it forms the economic climate in plenty of means. It is essential to keep in mind that the tax obligation code is subject and intricate to alter, so remaining educated is vital.